Bill and Sally

"We don't want to pay any more taxes than we have to."

Goals

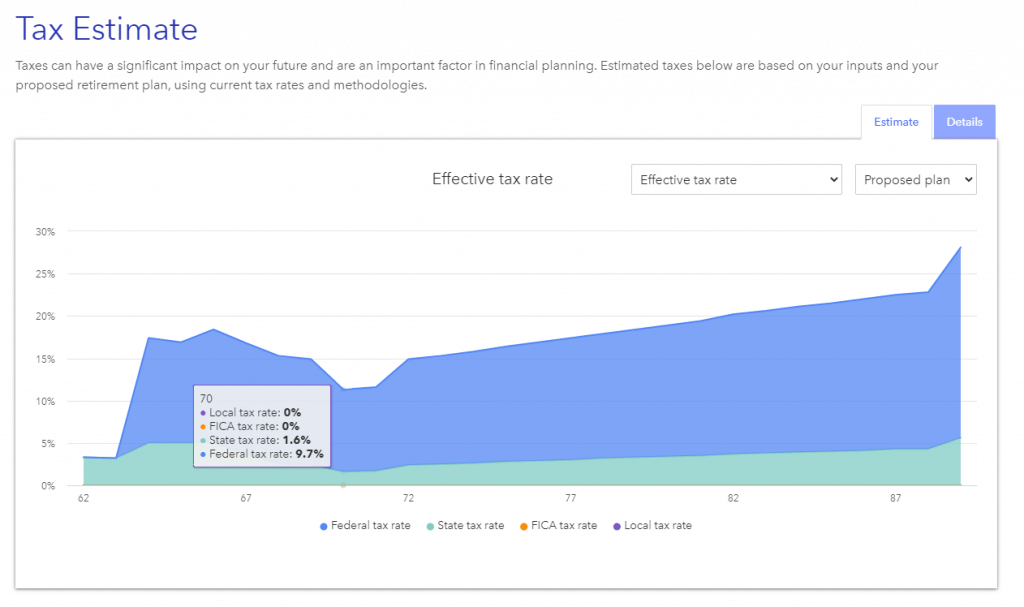

- Since they are concerned that taxes may go up in the future, they want to explore available strategies to reduce every bit of taxation they can.

- Pass on assets to their children.

About

- Bill is 66 and Sally is 64.

- Sally has a pension and they both have claimed Social security.

- All of their investments are in two IRAs and a joint investment account.

- They are considering moving to a lower tax state.

Areas of Focus

- Test available tax strategies to see what may work for them.

- Distribution strategy for IRA accounts so they do not get bumped in to higher tax brackets.

- They have unrealized gains in their joint investment account.

How We Helped

1

Step 1

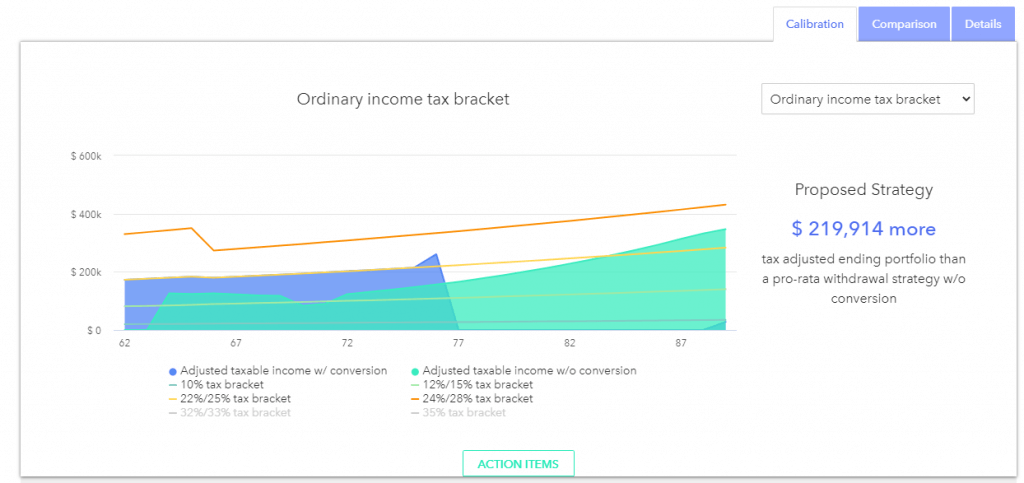

- Roth conversions

- Asset location strategy

- Tax bracket optimization

- Gifting strategies

- Tax-loss harvesting

2

Step 2

After running some analysis, we determined that converting their IRA assets over to Roth IRA made sense. In order for this to work, they needed to spread these out over the next 5 years to avoid hitting a high tax bracket. During this time, we utilized their non-retirement to cover additional living expenses and pay taxes on their conversions. Additionally, we implemented a tax-loss harvesting strategy that made their non-retirement more tax efficient.

3

Step 3

Since tax strategies change by administration, we will review and adjust strategies as needed. Regardless, they are positioned for flexibility and unknown implications of higher taxes in the future.

The Result

Bill and Sally felt they were positioned well if taxes went up in the future. They also felt like they would pass on assets to their children tax efficiently. We concluded that we would need to review this strategy every year because things change.

Related Resources

The Retirement H.E.A.L.T.H. Stress-test

Our modern financial planning process allow us to collaborate together so you can see the bigger pictures. This process was designed with you mind.

More Case Studies