Don and Jenny

“How do we know if we have enough?"

Goals

- Don and Jenny are not thrilled with their current jobs and want to know how soon they can leave them. They would much rather do something they love and enjoy. Since they are well-paid and diligent savers, they don't want to set themselves back from years of hard work.

- Their dream is to own a small campground.

- How to cover healthcare until age 65?

About

- Don and Jenny are in their late 50s.

- They have consistently saved 15% of their income for years and lived below their means.

- Since they have no kids and their home is paid for, they want to know, “Do we have enough?” If not, what else needs to happen?

Areas of Focus

- Making our investments last since they want to retire young.

- Build confidence that they can afford reasonable healthcare coverage.

- Implications of selling their home and buying a small business.

How We Helped

1

Step 1

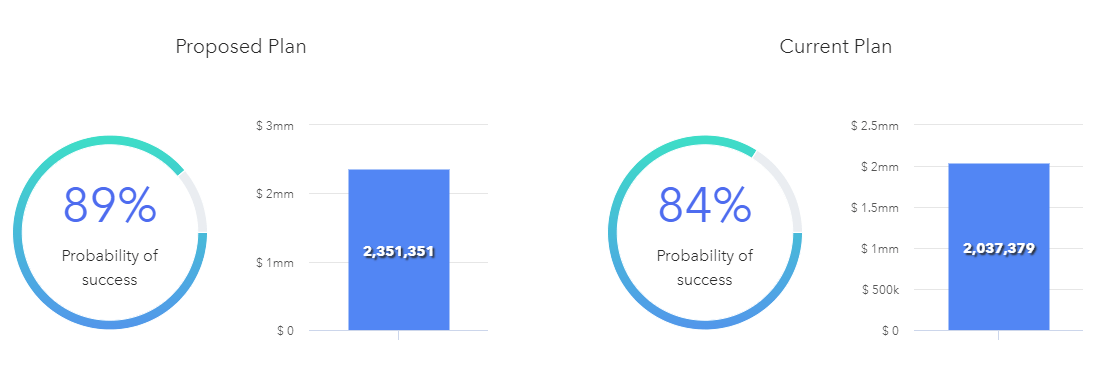

Our focus with Don and Jenny was probabilities-based planning through The Retirement H.E.A.L.T.H. Stress-test©. Our initial analysis showed they had an 84% probability of success with them leaving their jobs and not having any employment.

This scenario had reasonable probabilities of success, but we felt it needed to be higher with them being young.

2

Step 2

We tested a few scenarios and determined they could afford $500,000 toward the purchase a resort. We also assumed that the resort needed to produce $25,000 of annual income for them to maintain their living expenses. We also assumed they would sell their existing home. Should they spend more than this, it would put them more at risk.

3

Step 3

Since they were in their 50s, we created an investment strategy that did not expect any withdrawals until 10 years from now.

4

Step 4

A financial planning checklist was created so they could knew what variables they needed to check with their advisor to ensure they remained on track and stayed retired.

Related Resources

The Retirement H.E.A.L.T.H. Stress-test

Our modern financial planning process allow us to collaborate together so you can see the bigger pictures. This process was designed with you mind.

More Case Studies