How we help

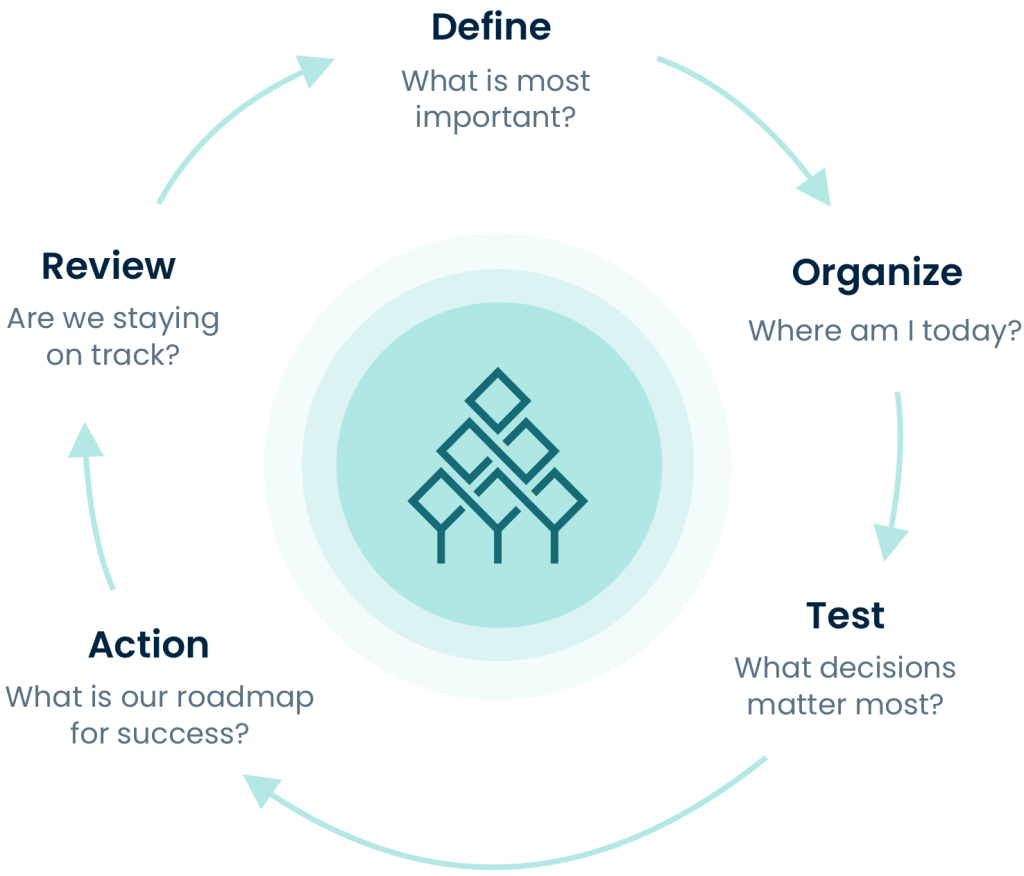

Our Process

Your financial life deserves a thoughtful, well-organized process instilling confidence in the opportunities that lie ahead.

1

Discover what is important.

There is more to financial advice than money. We want to hear your story and ask the right questions.

- What do you want your money to accomplish for you?

- Do you have a specific goal in mind?

- What experiences have influenced your approach to finances?

- How can we help?

2

Get organized.

We begin with understanding where you are today, what do you own and what decisions are in front of you. In order to be well-prepared for the future, we must organize today.

- What do you own?

- How much risk are you taking?

- Where is everything?

- What decisions need to be made today and in the future?

H

Household Income

Understanding your current and future income streams is crucial to building a consistent financial plan. Consistent income provides comfort and security no matter what stage of life you are in.

Questions that must be answered:

- How long do you plan to work?

- Would you retire today if you were prepared?

- What happens if you work one more year? Or one less?

- When should you claim Social Security?

- What pension option makes the most sense?

E

Expenses

The first step is understanding the consistencies of your expenses. Once you have a benchmark of your lifestyle, we can evaluate the confidence of maintaining your existing lifestyle while modeling additional scenarios. Most people are creatures of habit and maintain similar lifestyle throughout life. The problem is that something unexpected happens regularly.

We will help you discover:

- Personalized spending trends.

- What lifestyle are you working toward?

- Are there any large expenses in the near future?

- Can I afford __________?

- Retirement spending trends you should be aware of

A

Allocation

Your investment portfolio is the result of years of hard work and saving. That is why it is called your Nest Egg. Managing your investments in retirement will be different than when you were accumulating.

We help analyze:

- Current investments

- Risk tolerance

- Concentrated positions

- Fees and expenses

- How much income is needed from these accounts?

L

Longevity

Current life expectancy among retirees is on the rise. That coupled with earlier retirement dates, create a risk of longevity. No one wants to outlive their money!

We will assess:

- How soon can I retire?

- Am I at risk if I live past my life expectancy?

- Is my estate plan in order?

T

Taxes

Our tax system is complicated and only getting worse. Certain tax mitigation strategies work better than others. We want to proactively test and model strategies to see what works best for you.

Ways of taxation:

- Federal and State income tax

- Dividend, interest, and capital gains tax

- Retirement account distributions

- Medicare surcharge

- Social Security taxation

H

Healthcare

There are 3 stages of healthcare: pre-65, Medicare, and long-term care. Each stage has its own unique set of characteristics, costs, and challenges. We have compiled historical data to help estimate what you should expect at each stage.

- Costs of each stage of healthcare

- Different healthcare plans and your individual needs

- Thoughts on long-term care insurance

- Can you afford healthcare if no longer working

3

The Retirement H.E.A.L.T.H. Stress-Test©

Create a plan, stress-test it.

Each family has their own unique set of circumstances. We help you determine which decisions and choices move the needle most. Certain actions will be more impactful to your future than others.

Our proprietary financial planning process, The Retirement H.E.A.L.T.H. Stress-test© does just that. It helps you see the big picture. We created this process to help you see how one decision may impact another.

4

Take action.

A well-designed plan is almost certain to change over time. Life is full of constant change and adaptation. Financial independence is directly related to implementing the necessary action items today so you are prepared for the future.

“Unless commitment is made, there are only promises and hopes; but no plans.”

-Drucker