Will your savings last throughout your retirement? It’s a simple question — but one with weighty implications.

For many, it’s a question fraught with anxiety, as the answer depends on numerous variables, some of which are outside of your control: public policy, trade wars, real wars, etc. No one knows what markets will do tomorrow, let alone the next decade. Yet, it’s also a question that holds immense opportunity. Because you have more control over your financial future right now than at any other point going forward. With that in mind, it’s natural to prioritize savings and mentally tether your retirement readiness to your account balance. In practice, it’s more prudent to think through how you’ll tap into and use these funds over time.

When you retire, you won’t suddenly have to liquidate all of your holdings.

Generally speaking, only 5% or so of your portfolio should be needed to cover your first year of retirement, which means the remaining 95% is still set aside for one year and beyond. In the same light, you shouldn’t need to touch 50% of your portfolio for another 10 years. Most of your money isn’t for today — it’s for a future that stretches decades ahead. This means that a short-term market dip shouldn’t cause panic. Your long-term wealth is still working for you, growing and evolving as your retirement unfolds. Retirement Is a Multi-Act performance, not a single scene. Too often, retirement is framed as a stopping point. This is a misnomer. In reality, you have more control over where to allocate your energy, resources, and time. As you step away from your career, you gain something invaluable: the freedom to invest in the areas of life that matter most — family, health, purpose, and personal fulfillment.

However, just as your priorities evolve, so do your financial needs. Retirement isn’t static. Over the years, factors like spending patterns, tax laws, health care costs, and investment returns will shift. Without a plan that accounts for these interconnected variables, it’s easy to make siloed financial decisions, adjusting one piece while unintentionally jeopardizing another. Every passing day narrows the window to prepare, but that also means the sooner you address this question, the sooner you can celebrate, relax, and lead a fulfilling post-work life. This chapter (and the rest of this book) is dedicated to helping you explore the factors that determine how long your retirement savings will last. From understanding the pivotal role your spending rate plays to evaluating dynamic withdrawal strategies, you’ll gain the tools and frameworks needed to safeguard your nest egg.

Why Spending Rate Matters More Than Income

When planning for retirement, it’s natural to focus on how much income you’ll have. But the true driver of a long, financially secure retirement isn’t how much you earn — it’s how much you spend.

Your spending rate determines how quickly you draw down your savings. While this may seem straightforward on paper, real-life decisions tend to complicate matters. Let’s consider a simplified example:

You start retirement with a $1 million portfolio and withdraw $5,000 each month to cover expenses.

Assuming a 7% annual return and 3% inflation, your savings would last roughly 26.5 years.

What if you increase your spending by just $600 per month? Maybe it’s a few extra nights dining out, more rounds of golf, or even a new car payment. That’s about 4.5 fewer years of financial security. Of course, this hypothetical assumes fixed spending habits and doesn’t factor in guaranteed sources of income, such as Social Security. But it shows how even minor adjustments in your spending can have major, long-term implications. Fortunately, your spending rate is one of the most controllable levers you have in retirement. With the right plan and discipline, it can be adjusted as needed to not only preserve your financial well-being but also empower you to live (and spend) comfortably.

While $600 doesn’t feel too excessive, it has a material impact over time — shortening the lifespan of your savings to about 22 years.

What Is a Sustainable Spending Rate?

A sustainable spending rate evolves with you and the market. One way to achieve this flexibility is to establish retirement income guardrails — a dynamic approach that adjusts withdrawals based on market performance, the value of your portfolio, and life circumstances. At a high level, when markets perform well, you can increase discretionary spending and enjoy more flexibility. Conversely, during market downturns, reducing withdrawals helps preserve your portfolio and safeguards your long-term financial security. Historical data should be taken with a grain of salt, but the market produces positive returns roughly 7 out of every 10 years. Consequently, this strategy should lead to more years of comfort than belt-tightening.

Setting Your Initial Withdrawal Rate

What rate, exactly, will get you through retirement without a pantry full of ramen noodles and endless coupon clipping?

We wish it were as simple as giving you a percentage.

There are dozens of variables at play (unfortunately, life is complicated). That said, one practical approach to calculating your initial withdrawal rate is to estimate your annual expenses, accounting for any early retirement activities, such as travel or home renovations, that might inflate your budget.

If you’re not closely monitoring your budget, which is understandable considering life tends to get in the way, a simple starting point is to use your net income as a baseline.

For example, if you receive a direct deposit of $4,500 every two weeks, you could estimate your annual baseline spending at $117,000 ($4,500 × 26 pay periods) or $9,750 per month.

This method assumes you’re spending everything you make — which is extreme, but it’s helpful to err on the side of caution and work backgrounds.

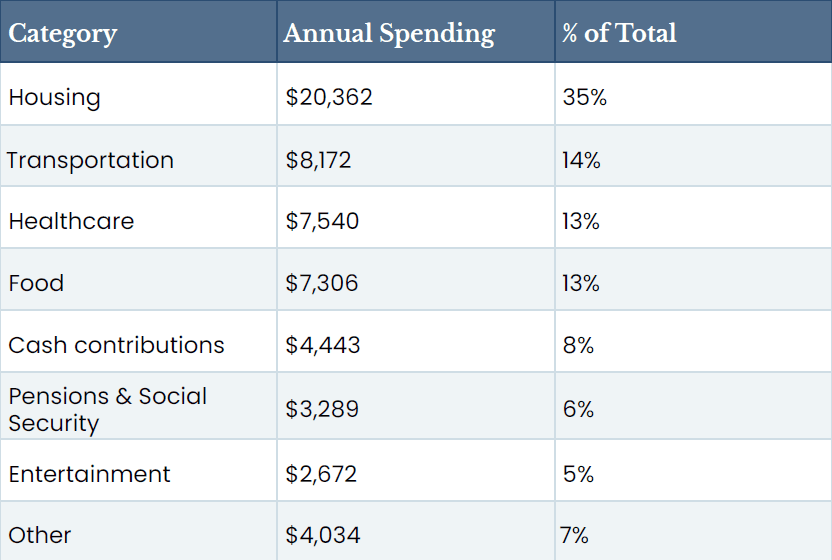

From there, you can refine your estimate with data. According to the Bureau of Labor Statistics, the average household led by someone 65 or older spends roughly $57,818 per year, with housing, transportation, and healthcare comprising the bulk of costs.

Bureau of Labor Statistics, “Consumer expenditures in 2022”

While averages and estimates should always be taken with a grain of salt, let’s apply this to a hypothetical scenario.

You anticipate some higher spending in your first year, so we’ll round this figure up to $60,000. Next, factor in guaranteed income sources — the average annual Social Security benefit is about $23,700 per individual. Subtracting this from your projected expenses leaves you with a gap of $36,300 that must be filled using your retirement savings or other income sources.

$60,000 Annual Expenses – $23,700 Social Security = $36,300 Spending Gap

Insight – If your spending rate is low enough (for instance, perhaps you continue to work part-time), you quite likely can afford to delay Social Security until circumstances force your spending rate higher — such as a market downturn, health event, or new living situation.

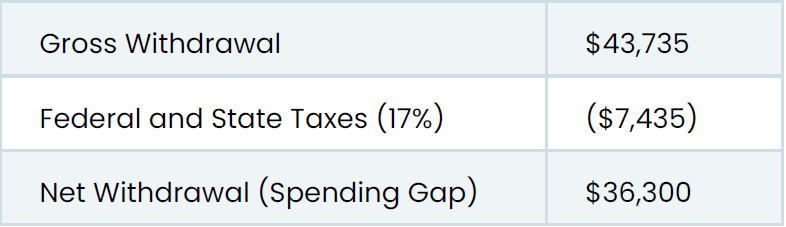

But don’t forget about taxes.

Depending on your total income, a portion of your Social Security benefits may be taxable, and your portfolio withdrawals could increase your overall tax liability. For simplicity, we’ll estimate federal and state taxes at 17% of your gross withdrawals. You’d need to withdraw approximately $43,735 ($36,300 / 83%) annually from your retirement portfolio to cover both your $36,300 spending gap and $7,435 of taxes (17% x $43,735).

With a $1 million portfolio, this translates to an initial gross withdrawal rate of about 4.4%.

This simplified example doesn’t capture every wrinkle — like fluctuating market returns, unexpected expenses, or inflation — but it highlights the importance of balancing your income needs, taxes, and portfolio sustainability as you plan for retirement.

Social Security Administration, “What is the average monthly benefit for a retired worker?”

Setting Guardrails for Spending

The next phase of this approach is calculating (and sticking to) your own guardrails. Generally, the parameters of your spending are set at +/- 20% of your initial distribution. Let’s walk through an example: For instance, let’s say you have a $1.2 million portfolio and set your initial distribution rate at 5% — that’s $60,000 per year or $5,000 per month. Your guardrails in this case would be 4% and 6%, based on a 20% buffer (20% of 5% = 1%). We’ll also assume Social Security isn’t in play yet.

Consequently, if your portfolio’s value falls to $950,000, your $5,000 monthly withdrawal would then represent a 6.3% withdrawal rate — which is outside of your 6% guardrail and would require you to cut spending. The same process would apply in the inverse scenario. If your portfolio’s value increased beyond $1.5 million, you’d surpass your guardrail ($60,000 / $1.5 million = 4%) and could boost your monthly withdrawal amount. While this is another simplified explanation, dynamic withdrawals can extend the life of a portfolio more.

effectively than static strategies.

How Sustainable is a “Sustainable” Withdrawal Rate Exactly? A Look at the 4% Rule

In the 1990s, financial planner William Bengen set out to answer this question by analyzing thousands of retirement portfolios during a critical bear market. His research gave rise to the famous “4% rule,” which suggests retirees can safely withdraw 4% of their portfolios annually (adjusted for inflation) and sustain their savings for at least 30 years. The 4% withdrawal rate is so robust that in 150 years of market history, there has never been a sequence of 30 years in which spending at that rate would have caused someone to run out of money (as of this writing). However, the 4% rule is not a universal solution. It was designed with worst-case scenarios in mind. Plus, it assumes a fixed 50/50 portfolio allocation of stocks and bonds. Depending on your personal circumstances and market conditions, you might be able to safely withdraw a higher percentage — as we illustrated with the guardrails approach.

Why a Straight-Line Approach Doesn’t Work

While the 4% rule provides a useful starting point, retirement spending is rarely linear. Life is dynamic, and so are your expenses. A concept known as the “spending smile” better reflects how retirees typically use their money over time.

Early retirement years: Spending often peaks as retirees embrace their newfound freedom to travel, pursue hobbies, and enjoy leisure activities.

Middle years: Expenses generally dip as retirees settle into routines and reduce discretionary spending.

Later years: Costs tend to rise again due to increased healthcare needs or long-term care expenses.

By factoring in lifestyle changes and needs, you can optimize your spending strategy for the stage of life you’re in. Otherwise, if you adhere too rigidly to a single percentage, you risk either under-spending and missing out on the best years of retirement or overspending and burning through your savings.

Markets Don’t Show Mercy: Understanding Sequence of Returns Risk

Just as spending is rarely linear, market performance is equally fluid.

Recall our earlier example that compared the long-term impact of another $600 in monthly spending; we assumed a 7% annual return. In all likelihood, over a long enough stretch of time, the returns of a balanced portfolio should average out to 7% or so. However, the market isn’t kind enough to deliver a smooth, predictable return year after year. Instead, performance is typically chaotic, delivering a varied sequence of returns. With an inevitable mix of up and down years, no one has control over whether they’ll start withdrawing in a strong or weak market. To illustrate how sequence of returns risk plays out in real life, let’s take a look at two retirees with identical $1 million portfolios, identical withdrawal rates ($55,000 per year), and identical annual returns (historical percentage change of the S&P 500) — but different start dates.

– Retiree A starts withdrawals in 1998, enjoying two strong years before the early 2000s crash.

– Retiree B starts withdrawals in 2000, stepping directly into a bear market.

This relatively slight timing difference has major implications. As you can see, Scenario A’s portfolio not only survives the proverbial “lost decade” but also almost holds its value over the ensuing 15 years. Meanwhile, Scenario B’s portfolio is completely depleted by 2015. (A solid argument for adopting a more all-weather portfolio allocation in retirement, versus 100% equities as this example implies.)

In retirement, early losses paired with withdrawals can permanently weaken your financial foundation. During down years, the same distribution represents a larger percentage of the whole, and a smaller one in up years. As your withdrawal rate rises and falls with your changing needs and market performance, it becomes a critical metric to measure and monitor to protect your goals.

That’s why a structured withdrawal strategy is so important. By incorporating flexibility through “guardrails” into your retirement income plan, you can mitigate sequence risk and keep your portfolio from unraveling too soon.

The Importance of Flexibility in Financial Planning

Retirement isn’t a straight path. In an ideal world, you would retire straight into a steady bull market with a portfolio that effortlessly supports your lifestyle. If only retirement planning were that simple.

Life will throw curveballs — Unexpected medical bills, market downturns, or family emergencies. However, what’s often more important is how you respond to and proactively plan for the factors you can influence. At Pine Grove Financial Group, we use our Retirement H.E.A.L.T.H. Stress-test© to help clients identify the areas where they have real financial control:

– Household Income: Deciding when and how to claim Social Security, generate retirement income, and manage distributions.

– Expenses: Understanding how spending patterns evolve and making proactive adjustments.

– Asset Allocation: Structuring your portfolio to withstand market volatility while supporting long-term withdrawals.

– Longevity Planning: Ensuring your wealth lasts across your full retirement horizon.

– Tax Strategies: Minimizing taxes through strategic withdrawals, Roth conversions, and tax-efficient asset placement.

– Healthcare & Long-Term Care Planning: Preparing for rising medical expenses and safeguarding your financial independence.

Flexibility in retirement planning doesn’t mean you have to constantly change course — it’s having a structured plan that allows for real-time adjustments when necessary. And that’s the difference between a rigid plan and a resilient one.

Key Takeaways

– How you manage withdrawals matters more than how much you’ve saved. Your spending rate — not just your income — determines how long your money lasts.

– The 4% rule is a guideline. It’s a useful starting point, but personal factors like market conditions, lifestyle changes, and tax efficiency should shape your actual withdrawal strategy.

– Regular reviews keep your retirement plan on track. Proactively assessing your portfolio, expenses, and income sources helps you stay ahead of financial surprises.

– Retirement spending isn’t a straight line. Most retirees spend more in early years, less in the middle, and more again later—your plan should adapt accordingly.

– Flexibility isn’t optional — it’s life-changing. Adjusting your withdrawals, investments, and tax strategy in response to changing conditions can add years to your financial security.