Advisor’s Insight – Featured Guest

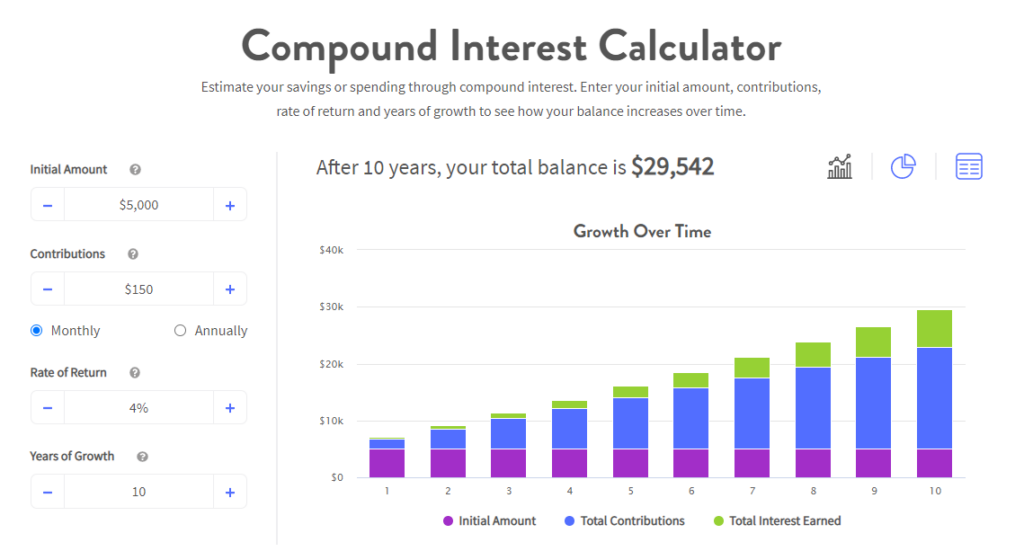

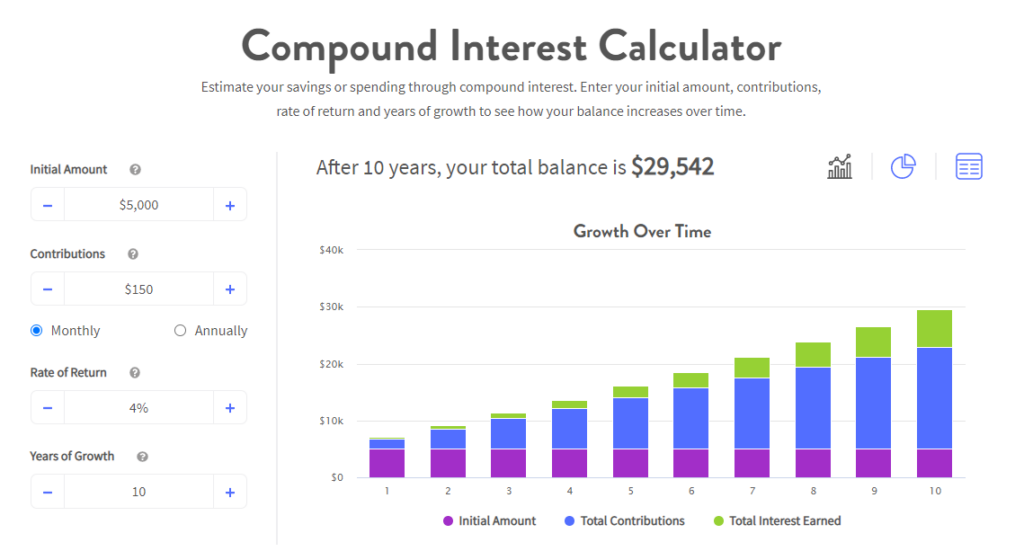

Recently Wealth Advisor Jeff Clark was featured by MoneyGeek.com to provide some expert insights on compound interest. CLICK HERE to see the article and use the MoneyGeek.com Compound Interest calculator.

Recently Wealth Advisor Jeff Clark was featured by MoneyGeek.com to provide some expert insights on compound interest. CLICK HERE to see the article and use the MoneyGeek.com Compound Interest calculator.