Most retirees budget for travel, hobbies, and everyday expenses, but many overlook the most unpredictable and expensive aspect of aging: health care.

- A 65-year-old today will need around $165,000 in savings just to cover health care expenses in retirement

- Only 27% of pre-retirees believe they’ll need longterm care. In reality, nearly 70% of retirees will need long-term care at some point in their lives.

- Medicare helps, but it doesn’t cover everything; expenses like dental, vision, hearing, and routine longterm care fall outside its scope.

Considering our medical needs only increase with age, these expenses can quickly become a leech on your retirement savings — without proper planning.

In this article, we’ll cover how to prepare for rising health care costs, how Medicare and supplemental insurance work, and how to create a plan for long-term care, so you can protect both your health and your financial future.

Why Health Care Is One of the Biggest Retirement Expenses

There’s no way to sugarcoat it: Medical care is expensive.

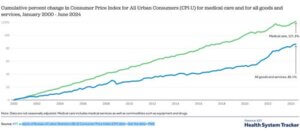

What many retirees don’t realize is that health care costs are rising faster than inflation. Since 2000, the cost of medical care — including services, insurance, prescription drugs, and medical equipment — has surged 121.3%, considerably outpacing the 86.1% increase in overall consumer prices.

There are several catalysts behind this trend:

- Medical advancements have improved treatment options, but they also come with higher price tags.

- An aging population means greater demand for health care services, driving up costs.

- Labor shortages in the healthcare industry have led to wage increases for medical professionals, which are expenses that eventually get passed on to patients.

Even with Medicare kicking in at age 65, retirees still bear a significant financial burden. That’s because Medicare doesn’t cover everything, such as:

- Routine dental, vision, and hearing care

- Most long-term care services (e.g., nursing homes and in-home care)

- Copays, coinsurance, and deductibles for outpatient visits and prescriptions

Retirees are also responsible for Medicare premiums and any supplemental insurance costs. When factoring in these added expenses, a typical 65-year-old retiring today will need an estimated $165,000 in after-tax savings just to cover health care expenses.

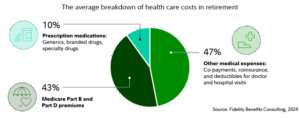

The Average Breakdown of Health Care Costs in Retirement

Needless to say, This is a substantial sum of money — and if you aren’t retired yet, your own future costs will likely be even higher. That’s why you need a plan in place before you stop working.

Medicare and Supplemental Insurance: What You Should Know

Medicare is the primary health insurance program for Americans 65 and older. To ensure you’re financially prepared for medical costs, it’s important to understand how this program works and decide whether you need supplemental insurance.

Forewarning: Medicare isn’t exactly straightforward. Although the following overviews have been consolidated and simplified, we highly recommend working with an advisor for a personalized walk through of these plans and coverage options.

How Medicare Enrollment Works

If you’ve worked and paid Medicare taxes for at least 10 years (40 quarters), you qualify for Medicare benefits at age 65. However, enrollment varies depending on your situation:

- If you’re already receiving Social Security benefits, you’ll be automatically enrolled in Medicare Part A and Part B when you turn 65. Together, these parts represent Original Medicare.

- If you aren’t receiving Social Security yet, you have to manually enroll in Medicare during your initial enrollment period, which begins three months before your 65th birthday and lasts for seven months.

- Medicare Advantage (Part C) and Medicare drug coverage (Part D) have separate enrollment — you are not automatically enrolled in these parts.

|

Insight: If you aren’t receiving Social Security and don’t sign up for Original Medicare when first eligible, you may face lifetime late enrollment penalties unless you have qualifying coverage (such as from an employer). |

Medicare Coverage Explained

Medicare consists of different parts, each covering specific services:

| Medicare Part | Coverage | Enrollment | Considerations |

| Part A (Hospital Insurance) | Covers inpatient hospital stays, skilled nursing facilities, hospice, and some home health care. | Automatic at 65 if receiving Social Security; manual otherwise | Usually premium-free, but you must meet a deductible before coverage begins. |

| Part B (Medical Insurance) | Covers outpatient care, doctor visits, preventive services, and some home health care. | Same as above | Requires a monthly premium and 20% coinsurance for most services after meeting the deductible. |

| Part C (Medicare Advantage) | A private insurance alternative to Original Medicare that bundlesParts A and B (and often Part D). | Must manually elect (replaces Original Medicare) | Generally covers everything Medicare does and often includes additional benefits like dental, vision, hearing, and wellness programs. Plan options and costs vary. |

| Part D (Drug Coverage) | Helps cover the cost of prescription medications. | Must manually elect (can combine with Original Medicare or some Part C plans) | Standalone plans have different premiums, deductibles, and copays. If you don’t enroll when first eligible, you may pay a lifetime penalty. |

If you only enroll in Original Medicare (Parts A and B), you’ll be responsible for copays, deductibles, and coverage gaps — which include prescriptions, dental, vision, and hearing. To access this coverage, you would have to elect for a Medicare Advantage plan that includes these benefits or purchase separate supplemental insurance.

Choosing the Right Supplemental Insurance

Many retirees choose to supplement their coverage with either:

- Medigap (Medicare Supplement Insurance): Works alongside Original Medicare to help cover out-ofpocket costs like deductibles, copays, and coinsurance.

- Medicare Advantage (Part C): Replaces Original Medicare with a private plan that bundles hospital, medical, and often drug coverage into one package (i.e., Parts A, B, and D). These plans are often more comprehensive with lower deductibles.

Medigap Plans

Medigap plans only supplement Original Medicare — they don’t replace it. These private plans cover some or all of the out-of-pocket costs that Medicare Parts A and B don’t pay.

Two popular Medigap plans include:

- Plan G: Higher premiums but provides comprehensive coverage, including 100% of costs for Medicareeligible services after meeting your Part B deductible. It’s the broadest of the Medigap plans and even includes foreign travel coverage.

- Plan N: Lower premiums but requires copays for some doctor visits and emergency room visits.

|

Insight: Medigap plans do not include prescription drug coverage (Part D), so you would have to enroll in a standalone Part D plan if you choose this option. |

Medicare Advantage Plans (Part C)

Medicare Advantage plans are privatized and bundle the other coverage parts into a single plan. These plans often include extra benefits like dental, vision, hearing, and fitness programs, but they come with network restrictions and varied out-of-pocket costs.

| Plan Type | How It Works | Considerations |

| Health Maintenance Organization (HMO) | You would see in-network doctors and get referrals for specialists. | Usually lower premiums but less flexibility in choosing providers. |

| Preferred Provider Organization (PPO) | Covers both in- and out-of-network care, but out-of-network services cost more. | Higher premiums than HMOs but more provider flexibility. |

| Private Fee-for-Service (PFFS) | Allows you to visit any Medicare-approved provider that accepts the plan’s payment terms. | Not all providers accept PFFS plans, so access may be limited. |

| Medicare Savings Accounts (MSA) | Combines a high-deductible Medicare Advantage plan with a savings account to pay for care. | No prescription drug coverage, so you would need a separate Part D plan. |

Keep in mind, there are many plan options — the average enrollee had 43 to choose from in 2024. These plans have different cost structures than Original Medicare, so compare policy features before making any final decisions.

Which Plan Is Right for You?

The right choice depends on your budget, health needs, and preference for flexibility.

| Factor | Medicare Advantage (Part C) | Medigap + Original Medicare |

| Upfront Costs | Typically lower monthly premiums | Higher monthly premiums |

| Out-of-Pocket Costs | May have copays, coinsurance, and deductibles | Covers most out-of-pocket expenses |

| Doctor Flexibility | Limited to plan’s network (except PPOs) | See any doctor who accepts Medicare |

| Prescription Drug Coverage | Often included | Requires separate Part D plan |

| Additional Benefits | Dental, vision, hearing, wellness programs | No additional benefits |

Many retirees prefer paying higher premiums for more comprehensive coverage since it simplifies budgeting and minimizes surprise expenses. Others opt for Medicare Advantage for its lower premiums and bundled benefits, but, in turn, have to stay within a provider network.

The Long-Term Care Dilemma: A Growing Financial Concern

Nearly 70% of adults who reach age 65 will need some form of long-term care in their lifetime, and one in five will need it for at least five years.

It’s easy to push this reality aside. No one wants to imagine themselves needing daily assistance, but ignoring the risk won’t make it go away. And without a plan, long-term care costs can negatively impact savings, loved ones, and an otherwise financially secure and fulfilling retirement.

Let’s take a closer look at what long-term care actually costs — and how you can prepare.

| Long-Term Care Need | Likelihood |

| Adults 65+ who will develop severe long-term care needs before death | 70% |

| Adults 65+ who will receive at least some paid long-term care services | 48% |

| Adults 65+ who will spend at least 90 days in a nursing home | 28% |

| Adults who need long-term care for five years or more | 20% |

| Adults 85+ who require long-term care | 54% |

| Adults 85+ who require nursing home care | 34% |

The Cost of Long-Term Care

Health care is expensive, but long-term care is in a category of its own. These costs vary substantially by state, too. In Minnesota, for instance, the average cost of a semi-private room in a nursing home is over $130,000 per year.

| Long-Term Care | Average Monthly Cost |

| Nursing Homes (Semi-Private) | $10,907 |

| Nursing Homes (Private) | $13,585 |

| Home Health Aides | $7,040 |

| Assisted Living | $5,040 |

Moreover, many retirees assume Medicare will foot the bill, but that’s not the case. While Medicare does cover short-term skilled nursing care, it does not cover ongoing, routine long-term care needs like nursing homes, assisted living, or in-home assistance.

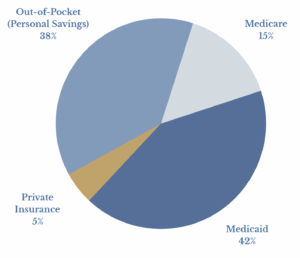

A recent study analyzed lifetime long-term care expenditures for individuals aged 65 and older; here’s how participants generally afforded their care:

Medicaid is the largest payer of long-term care services, but it’s a means-tested benefit — you’d have to spend down practically all of your assets before qualifying.

Planning Strategies for Long-Term Care

There are three primary strategies to cover long-term care costs:

| Strategy | How It Works | Considerations |

| Long-Term Care Insurance | Private insurance policy covering nursing homes, assisted living, and in-home care. | Premiums can be high, and coverage varies — some policies have long waiting periods or payout limits. |

| Hybrid Insurance Policies | Life insurance or annuities with long-term care benefits. | May provide flexibility, but fees and coverage limits can be restrictive. |

| Medicaid Planning | Legally restructuring assets to qualify for Medicaid-funded nursing home care. | Must be done at least five years in advance due to Medicaid’s five year lookback rule. |

So, which one is right for you?

Much like health care coverage, longterm care planning is nuanced and personal. Policies can help you cover needed services, but premiums tend to be expensive — a 65-year-old couple can expect to pay between $3,750 and $9,675 annually for long-term care insurance.

On the other hand, Medicaid planning involves working with an estate attorney to shield assets so you can qualify for Medicaid coverage for nursing care without impoverishing yourself in the process.

This approach typically involves creating and funding a trust. Of course, there are costs to do so, and it must be done at least five years before long-term care is needed because of the Medicaid five-year lookback rule. But Medicaid planning has a significant advantage in that you don’t spend money on insurance premiums and your assets remain available regardless of whether you do or do not need nursing care.

You may have one additional option. If you’re delaying Social Security, deferring a pension, or incorporating annuities into your plan, these can act as a “soft” LTC policy — one that doesn’t require medical underwriting.

Since these income sources follow a longevity curve — meaning the older you are when you claim, the higher your payout — you can strategically time these benefits to provide additional financial stability in your later years. They don’t outright replace the coverage and features of a LTC policy, but they at least establish a guaranteed income floor.

Needless to say, This is not a decision to take lightly. You may even consider a combination of self-funding, insurance, and Medicaid planning.

We highly recommend working with an advisor to determine the best path forward for you.

Preparing for Rising Health Care Costs With HSAs

Health care will likely be one of your largest expenses in retirement. While Medicare and supplemental insurance help offset expenses, retirees still need to plan ahead to cover premiums, out-of-pocket costs, and potential longterm care needs.

Just like housing and food, health care should be treated as a standard expense in your retirement budget. Consider creating and allocating monthly savings to a dedicated health care fund to help absorb unexpected medical costs without disrupting your core retirement income.

If you’re still working and have a high-deductible health plan, an HSA is one of the best ways to prepare for future medical expenses. HSAs offer a triple tax advantage that no other retirement account provides:

- Tax-free contributions: Contributions are made with pre-tax dollars, lowering your taxable income.

- Tax-free growth: Your money grows tax-free when invested.

- Tax-free withdrawals: If used for qualified medical expenses, withdrawals are completely tax-free.

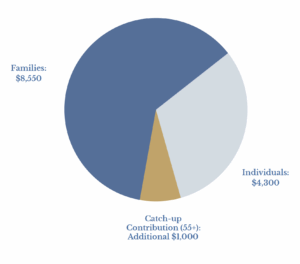

Even better, HSA funds never expire — they roll over indefinitely, which makes them an excellent savings vehicle for retirement health care. If you or your family have a history of health issues, you may want to max out your HSA contributions each year to prepare for future costs.

2025 HSA Contribution Limits

Key Takeaways

- Understand what Medicare covers — and what it doesn’t. Gaps in coverage, including dental, vision, hearing, and routine longterm care, mean you’ll likely need supplemental insurance.

- Choose the right Medicare plan for your needs. Whether you opt for Original Medicare with a Medigap policy or a Medicare Advantage plan, weigh the tradeoffs between lower premiums and potential out-of-pocket costs.

- Plan ahead for long-term care. With nearly 70% of retirees needing some form of long-term care, consider strategies like long-term care insurance, hybrid insurance policies, or Medicaid planning — or a combination of strategies.

- Take advantage of your HSA if eligible. If you have an HSA, contributing and investing those funds throughout your working years can provide a potent tax-free resource for future medical expenses.

Taking these steps Can help you maintain financial stability and access to quality health care throughout retirement.